pay ohio unemployment taxes online

Apply for Unemployment Now Employee 1099 Employee Employer. It is not deducted from the employees wages.

Labor Employment Alert Guidance On Ohio Unemployment Compensation Brouse Mcdowell Ohio Law Firm

If you are unable to register and this is your first time filing an Ohio income tax return or School District Income Tax return you are not eligible to file electronically using Ohios Income Tax Online Services for the current tax year.

. Bank Account Online ACH Debit or Credit Card American Express Discover MasterCard or Visa from the Make Payment page. When you enter wage information the Gateway automatically calculates the taxable wages and contributions taxes due for you and provides payment options. Payments by Electronic Check or CreditDebit Card.

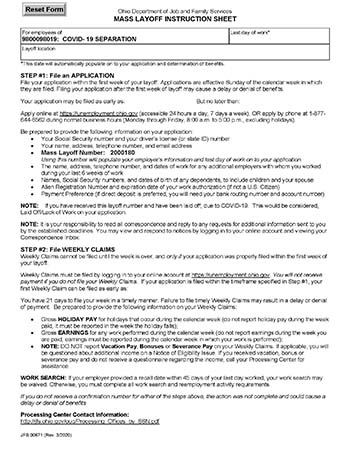

What are the consequences of failing to file or pay unemployment insurance taxes. If you are disconnected use your username and PIN to log back on and resume the application process. Ad File your unemployment tax return free.

Your application is not filed until you receive a confirmation number. For general payment questions call us toll-free at 1-800-282-1780 1-800-750-0750 for persons who use text telephones TTYs or adaptive telephone equipment. Ohio Department of Taxation.

Most employers pay both a Federal and a state unemployment tax. On June 14 2022 the Ohio Department. Select the Payments tab from the My Home page.

Online Services is a free secure electronic portal where you can file and pay your Ohio individual and school district income taxesYou can also review notices and information about those taxes from the Department. Submit the payment if paying by ACH. School District Failure to File Notice.

Once the missing Quarterly Tax Return is processed you will be assessed penalty and interest. Select a payment option. Up to 25 cash back That amount known as the taxable wage base has been stable at 9000 in Ohio since the year 2000.

Once you have registered and received a User Name and Password click the Log-On to Existing Account button. 100 free federal filing for everyone. How To Get W2 From.

The Ohio Department of Job and Family Services Mike DeWine Governor Matt Damschroder ODJFS Director. Do You Have To Pay Taxes For Unemployment. Report it by calling toll-free.

If you are the account administrator for your. The online initial application takes about 25 minutes. If you are remitting for both Ohio and school.

Free to File Easy to Use Faster Refund Log in to secure zone. Should you have any questions please call the contribution section at 614-466-2319. Payments made online may not immediately.

Department of Labors Contacts for State UI Tax Information and Assistance. Premium federal filing is 100 free with no upgrades for premium taxes. Please use the following steps in paying your unemployment taxes.

JFS-20106 Employers Representative Authorization for Taxes. File Unemployment Taxes Online. To file and pay online you can use either the ERIC system or the Ohio Business Gateway.

The Ohio Business Gateway is another option available to submit current quarter unemployment reports and payments. Ohio Department of Taxation Individual Income Tax Online Services - Login. Additional information about the Ohio Unemployment Tax can be obtained from our home page or by contacting the Division of Tax and Employer Service at 614 466-2319.

There are two resources that assist Ohios employers in navigating the unemployment insurance system. On Employer Login page select and click Register to maintain TPA account online link. Used by employers to authorize someone other than the employer to provide.

To submit your quarterly tax report online please visit httpsthesourcejfsohiogov. It is available 24 hours a day 7 days a week except for scheduled maintenance. Paper Form Exception Filing Information In Ohio employers are required to submit their Quarterly Tax Return.

You will need to file a new claim if you have not applied for unemployment benefits at any time in the past 12 months. Starting August 9 2022 the Ohio Department of Taxation ODT will begin mailing non-remittance billing notices to taxpayers who have not paid in full their 2021 Ohio individual andor school district income tax liability reported on their return s. Rel 20221 - 05012022Build No35 on 1.

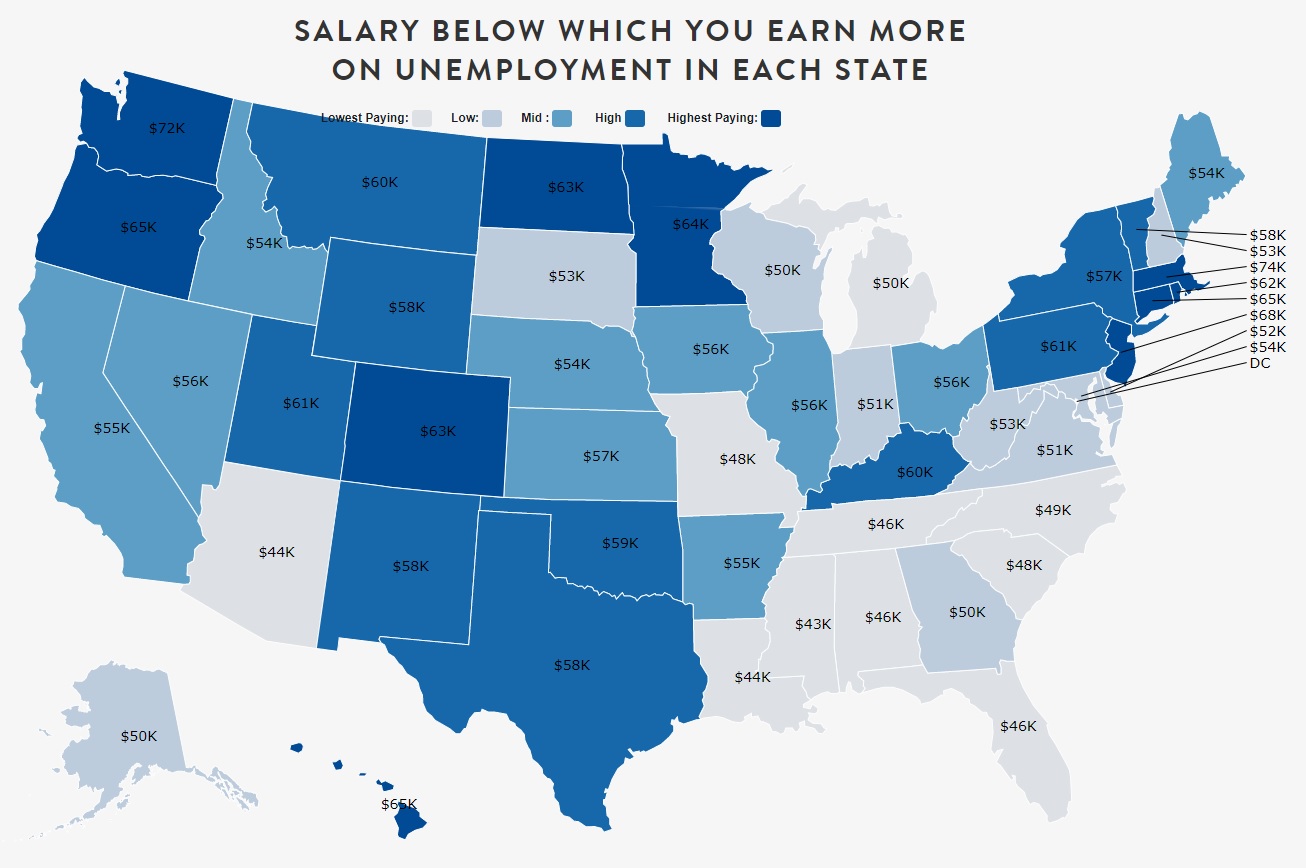

In recent years however it has been stable at 27. For a list of state unemployment tax agencies visit the US. Logon to Unemployment Tax Services.

Several options are available for paying your Ohio andor school district income tax. The Gateway populates previously reported employees and wage data. For more information refer to the Instructions for Form 940.

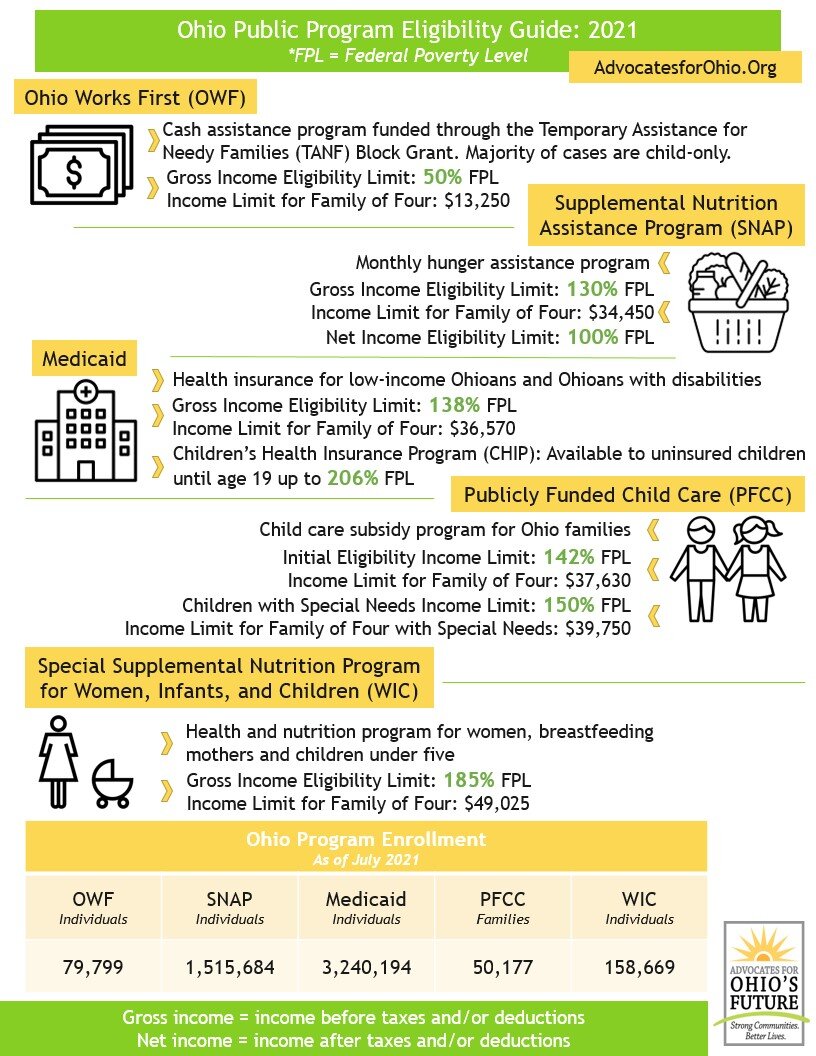

JFS-20125 UC Quarterly Tax Return. True Coronavirus and Unemployment Insurance Benefits Resource Hubs Please review our employee and employer resource hubs for more information on unemployment benefits related to COVID-19. You may apply for a waiver of these assessments.

The Employer Resource Information Center ERIC is a self-service unemployment compensation tax system that helps employers and third-party administrators get account numbers secure web access file quarterly reports make. Register Forgot my user ID password. The state UI tax rate for new employers also known as the standard beginning tax rate can change from one year to the next.

Employers who pay unemployment contributions. Used by employers to submit quarterly wage detail and unemployment taxes. To register as the Employer Representative click on the Create a New Account button below.

However its always possible the amount could change. Only the employer pays FUTA tax.

News Advocates For Ohio S Future

Income General Information Department Of Taxation

Reporting Of Other Government Payments

An Agricultural Employer S 2021 Tax Obligations A Series Part Ii Farm Office

Taxes Faqs Ohio Gov Official Website Of The State Of Ohio

Labor Employment Alert Guidance On Ohio Unemployment Compensation Brouse Mcdowell Ohio Law Firm

Pandemic Unemployment Assistance Pua Calculator For Self Employed Freelancers And Gig Workers Zippia

Labor Employment Alert Guidance On Ohio Unemployment Compensation Brouse Mcdowell Ohio Law Firm

Quickbooks Online Automatic Tax Calculation